- BOOKKEEPING FOR SMALL BUSINESS HOW TO

- BOOKKEEPING FOR SMALL BUSINESS SOFTWARE

There are plenty of software options available too.

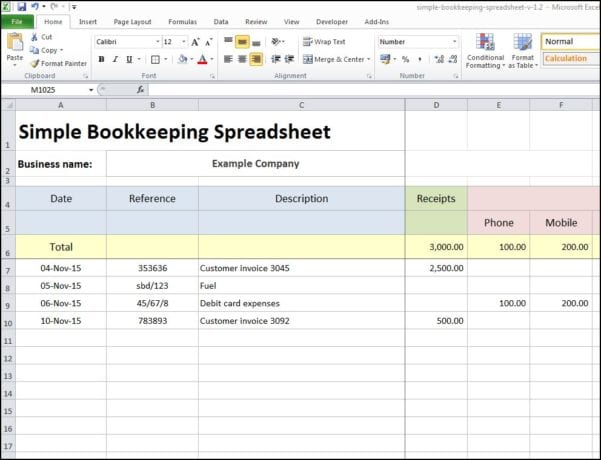

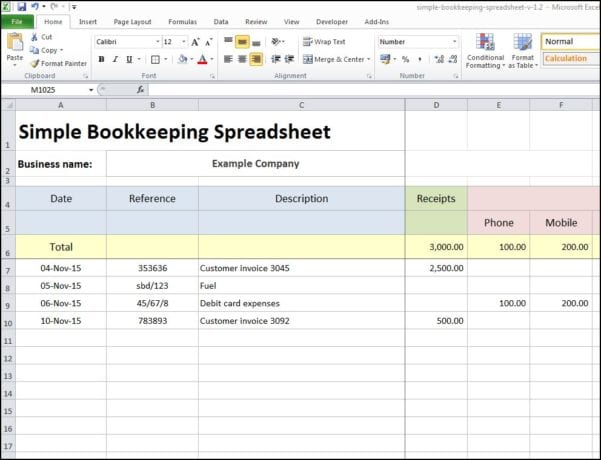

Now, accounting software has made it much easier to collate, read and then report on your accounting. It used to be that accounts were recorded using physical books and pens, which meant laborious data entry by hand, with human error being common.

The first thing you need to know about bookkeeping for a small business is that technology has changed the game entirely. The basics of bookkeeping for a small business

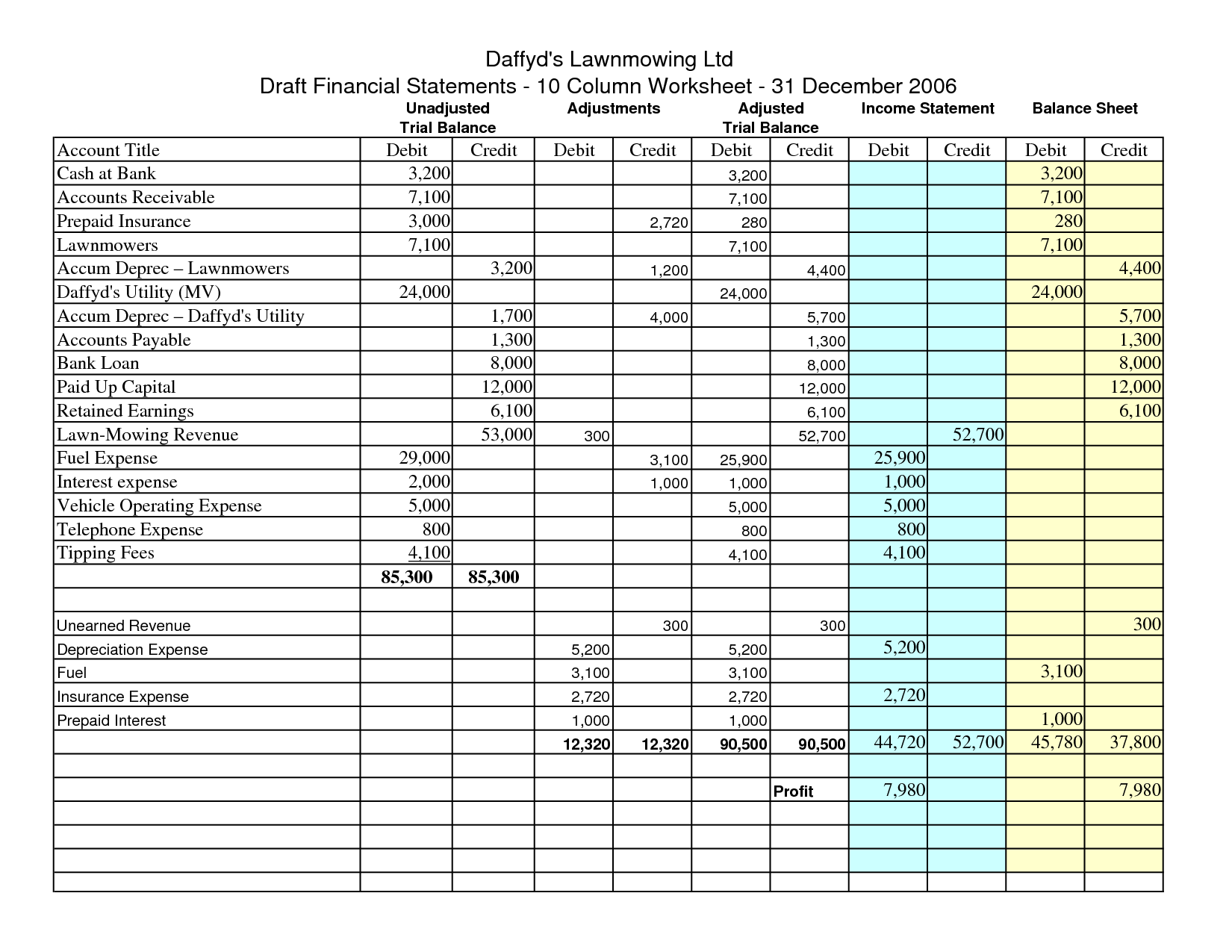

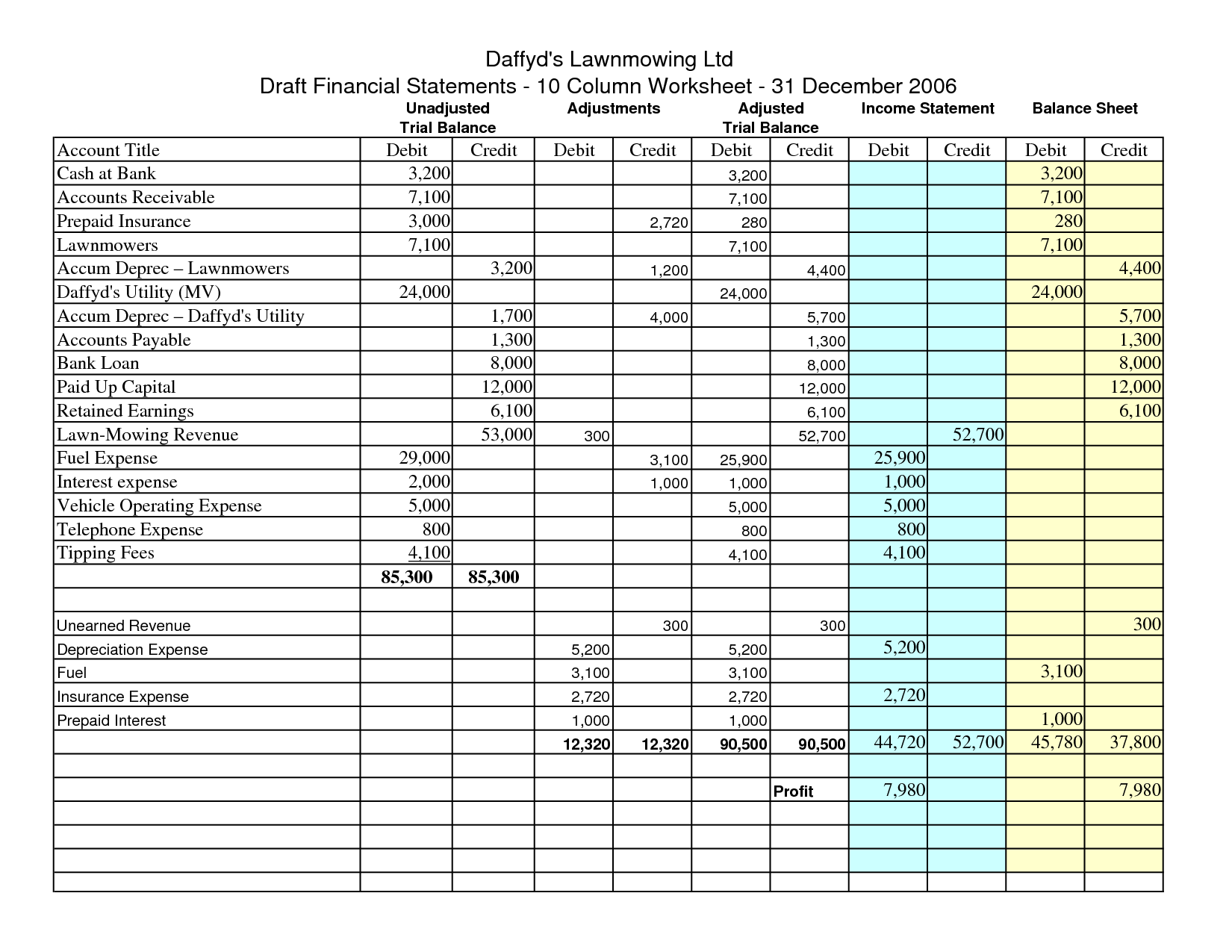

The more you know about bookkeeping for a small business and some basics of accounting, the better you’ll manage your finances and start growing your business. But without it, your small business will struggle to succeed. We’ll cover those options in more detail, but one thing to remember is that it’s always a good idea to have a meeting with a certified accountant before you launch your business (or as soon as possible if you’re already trading).Īll businesses are different and will have to approach their bookkeeping in slightly different ways. While small business bookkeeping can seem daunting, there are ways to make it easier for yourself. These are the bare minimum when it comes to the basics of accounting and should form the basis of all bookkeeping for a small business.

Purchase invoice : This final record will cover everything you’ve spent money on and include details of how those payments were made. Sales invoice : This is the record of everything you have sold and includes payments made to you and any unpaid invoices. Cashbook : This will be the details of your cash flow - a record of every payment that goes in and out of your business’s bank account. It uses three different kinds of financial records: Ensuring that you’re paying the right amount of tax (or claiming the right amount back)īookkeeping for a small business means tracking all of the payments that go in and out of your business. Chasing any outstanding payments from your customers. It will cover everything that happens in a workday, including: What does bookkeeping involve?īookkeeping is all about the day-to-day finances of your small business. So while accounting will be looking more at finance analysis and developing financial strategies, bookkeeping is recording and then reporting on information regarding your finances. That’s because bookkeeping is a part of the general accounting function. It’s typical for bookkeeping to be confused with accounting. Is bookkeeping just another word for accounting? With that in mind, here’s everything you need to know about bookkeeping for a small business and why it’s one of the most important basics of accounting. And without those insights, trying to grow your small business is going to be much more difficult. You won’t have a good idea of how much you’re earning, nor how much you’re spending. The fact is that if you ignore your bookkeeping, you will have an extremely limited view of your company’s finances. BOOKKEEPING FOR SMALL BUSINESS HOW TO

Sounds simple, right? Well, despite that seeming simplicity, most small business owners have little to no understanding of what bookkeeping is, how to do it or why it’s so important. At its most basic, bookkeeping is simply recording all of a business’s financial transactions.

0 kommentar(er)

0 kommentar(er)